Accounting and Tax

Cover your annual reporting requirements. Optimise your tax savings.

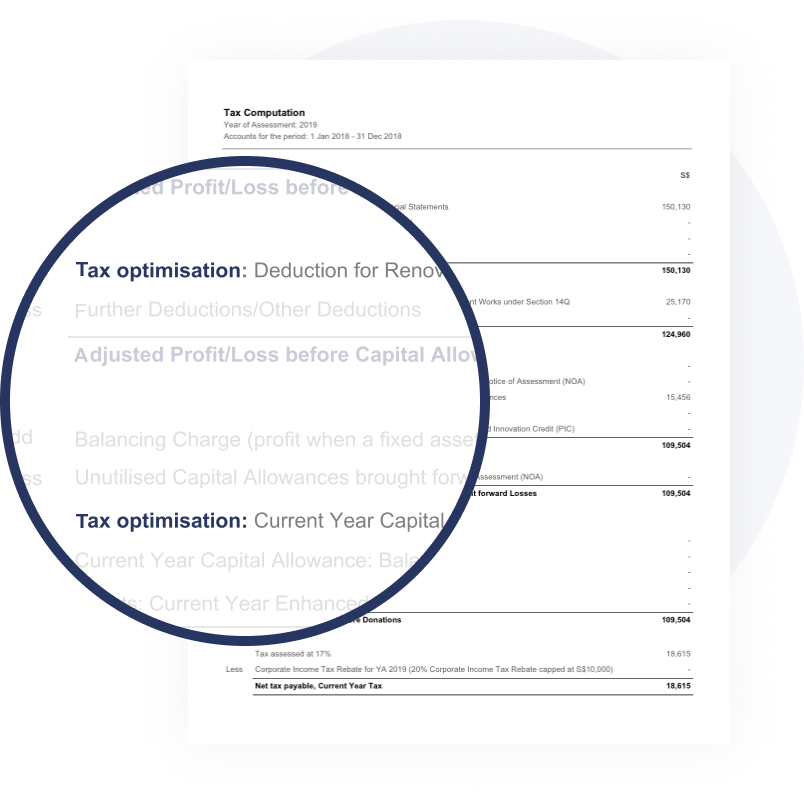

Optimise your tax savings

We thoroughly comb through your transactions to help maximise tax deductions. This includes planning your capital allowances, S14Q claims, and donation claims to fully utilise your tax allowance.

Powered by a team of thoughtful professionals

Our team of accounting and tax professionals are fully qualified and they go the extra mile to understand your business requirements and situation to ensure that things are done right.

Powered by a team of thoughtful professionals

Our team of accounting and tax professionals are fully qualified and they go the extra mile to understand your business requirements and situation to ensure that things are done right.

Full compliance with statutory requirements

Our plans are designed to cover all your statutory and compliance requirements and your tax filing requirements. Being compliant will help you avoid some of the fines and penalties commonly faced by companies.

Fuss-free process

Let us do that hard work of sorting through your bills, invoices, and bank statements to generate your annual reports. Sit back, relax, and we will handle the rest.

Our entire business group relies on Cabin to do our financial reporting and taxes. We have multiple financial year ends and varied businesses. Now, we never have to worry about missing deadlines or errors in filings. Cabin has been right on track and even provided useful insights which never saw previously.

Lucy Chng, Director, Elements Wellness Group